As we know, everything in this world revolves around money. Whether you’re in the heart of Africa or in the bustling streets of New York there’s no escaping the fact that money is the all-important power that drives absolutely everything.

We all know that money is different from country to country, but do we really know quite how much differentiation there is between nations? From the dollar and the pound to the dong and the rupiah, money comes in all shapes, sizes, colours, denominations and values.

Currency value is by far the most important variable. The value of any given legal tender is determined by a number of global social and economic factors meaning that a currencies worth is always fluctuating. The only way to truly judge the value of a currency is by comparing it to another, and it’s fair to say that the disparity between any two can be amazing.

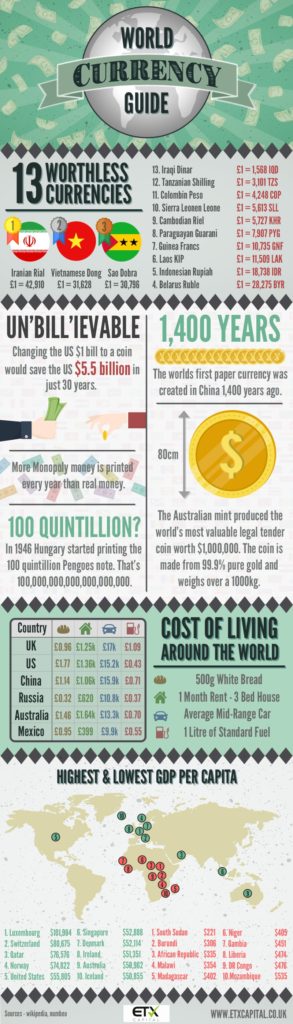

For example, as shown in the infographic a single Great British Pound is worth 42,910 Iranian Rial. That means that if you change £23.30 into Iranian Rial you’d technically be a millionaire. Although this sounds like a dream come true, the reality is that almost everyone in Iran will also be a millionaire due to unbelievable inflation rates that has resulted in their currency being almost worthless. However, when it comes to talking about worthless currency the Zimbabwean dollar can’t go without a mention.

Zimbabwe Dollar

Upon gaining independence in 1980 Zimbabwe introduced their new dollar which was at the time around 25% more valuable than its US counterpart. By 2008 the value of the Zimbabwe dollar had decreased so rapidly and significantly that a $500 million note was introduced just to account for the uncontrollable inflation. The $500,000,000 was equal to around $2.50 US or £1.70 UK.

The $500,000,000 Zimbabwe dollar is surprisingly not the highest denomination legal tender note in history. That accolade is held by the Hungarians who were forced into printing and putting a 100 quintillion Hungarian Pengoesnote into circulation. That’s 100,000,000,000,000,000,000.

Chinese Notes

It would be hard to imagine a world without paper money but it hasn’t always been at our disposal. Paper bills were first used by the Chinese who started carrying foldable money during the Tang Dynasty (A.D. 618-907). This was used for more than 500 years before the practice began to catch on in Europe around the 17th century. It took a further 2 whole centuries before paper money was adopted worldwide.

By the 17th century China was already going through a fairly advanced financial crisis as the production of paper notes grew exponentially causing the currencies’ value to plummet significantly and subsequently sending inflation rates through the roof. As a result, China were forced to eliminate their paper money entirely in 1455 and wouldn’t decide to re-adopt it again for a several hundred years.

This infographic was researched, produced and provided by ETX Capital. ETX Capital is a UK based company that provide multi-asset market derivatives trading through financial spread betting and CFD products.