On a yearly basis, there are a number of senior citizens that miss out on a major opportunity to sell their life insurance, instead they just let their policy lapse and stop paying it. Many times these individuals don’t even realize the consequences of letting their life insurance policy lapse, they just view it as one less bill to pay. There’s an alternative to just letting your policy lapse, and it may net you greater financial security than you’ve ever realized. This alternative comes in the form of selling your life insurance policy.

Let’s get the basics squared away first. Selling your life insurance policy entails an agreement to sign over the rights to your insurance disbursement to a company or entity, often in the finance or insurance sector, and in return, they will continue to make the timely payments on your life insurance policy. This exchange results in you receive an instant benefit in the form of cash or check, based on an agreed upon amount. The company taking on the burden of the policy receives the full amount of the policy payout once the policyholder has died.

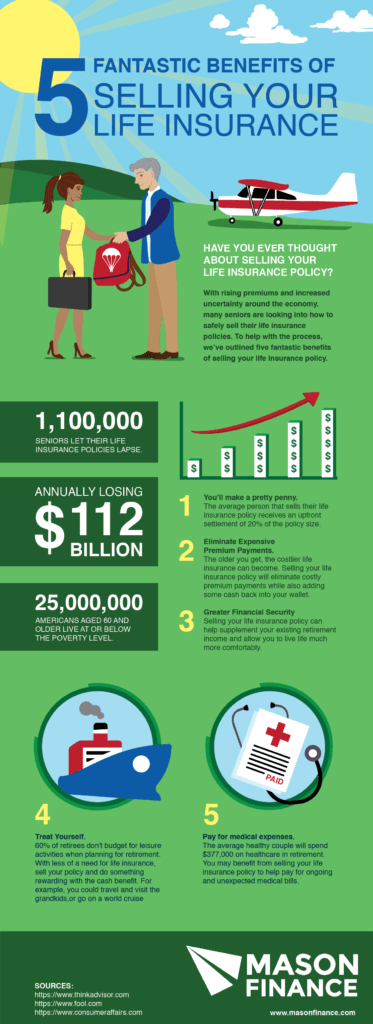

Why on earth would someone leave free money on the table, you ask? Well, they’re completely unaware that selling their life insurance policy for cash benefit is even an option. While currently less than ten percent of people are capitalizing on the life settlement market, we’ll make sure you’re one of the well informed to take advantage of this opportunity. Below in an infographic created by Mason Finance, we’ve outlined five fantastic benefits of selling your life insurance policy.