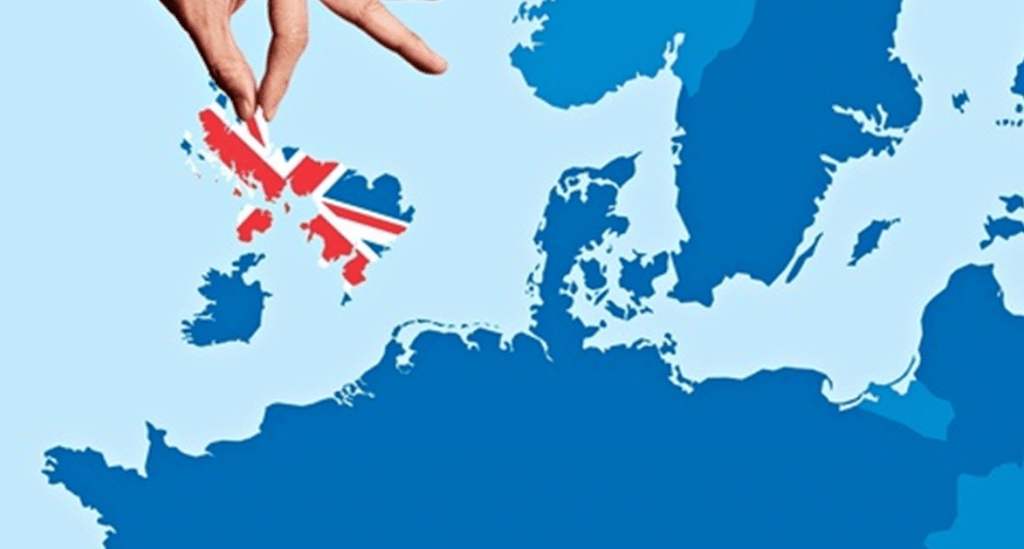

Britain’s “Exit” (Brexit) from the European Union last week has many critics, financial analysts, and economically intuned individuals speculating the fallout to come. In particular, the United States (US) markets are bracing for a possible crisis due in part by longer than investors would like low-interest rates. For the US consumer who let’s say, buys a home today enjoys great low rates. Yet prolonged low-interest rates will cause earning a return on long-term savings to be so minute, it really would not even show reason to consider it anymore as a perk to saving. So the already low on saving economy will see a decline in the average “Joe” who is not inclined to do so already will find it hard to even fathom it. CD’s which already have low-interest rates will just be a holding funds hostage product banks will offer those who need extra measures to curb spending. A fund that gets more from penalty fees for early retrieval of them than one would ever receive in interest sitting there is not too appealing. Really having a CD will not show much benefit and with an economy of more savvy researching consumers, the new terrain will be found out. How will one online learning about impact of low-interest rates on investments and savings products going to react? Bloomberg did a national poll to see how the Brexit fallout is seen by Americans. The findings, we expected them in the poll responses since the US is a capitalist country..

When polled, most Americans put more weight on the global economic impact. This national poll depicts the most weighing concern is the global economy.

“More than a third of U.S. voters see the U.K.’s decision to leave the European Union as damaging to the American economy and four in 10 of those who have stock market investments say it will hurt their portfolios.” – Bloomberg .

We are currently dealing with low-interest rates which for the consumer who are not an investor, loves. They purchase a home at a lower interest rate, the less they pay. Yet, when the Federal Reserve (Fed) looks to stabilize the economy by increasing the interest rate to get money flowing back into the economy, those enjoying this lengthened period of low rates will not be too happy. They now will be purchasing homes at higher rates making the banks and investors happy. They can now see gainful returns on their investments. Now, investors are not fond of lower rates because they returns a smaller. So it is a slippery slope we have been sliding on since the Fed decided to ease economic pressure on a sky rocketing unemployment rate economy but is also hurting the country’s growth.

The US economy is fueled by the dollar who I might add is doing a bit better yet still weak. We want the money and we want it now. The European Union (E.U. or EU) exit by Great Britain still has many months to show initial impact. Right now there is confusion by the Brits, shown by the high search traffic from the United Kingdom by its citizens recorded by Google. This shows many were not fully aware of a EU or did not fully comprehend what it was all about. Many are putting immigration as a reason to leave and others are saying it was due to the sad decline of the gilt. One thing for sure, Britain now is in full control of its country and one thing to really observe is how other nations now will deal with the UK financially. It is weird putting online search into focus, yet they are the one place we get our clout from overseas. Now that is an area to watch in the future.

“…Britain is the main channel through which America expresses its economic and political will in Europe. Its exit from that stage will undoubtedly make it harder to assert any American agendas around trade, digital privacy, global tax reform and such in Europe. “ – Time .

To conclude on my thoughts as to how will the US economy deal, it will have to suck it up and navigate the choppy waters to come. The Fed will keep low-interest rates that will favor consumers but leave investors wanting a hike in rates so they see better returns on their investments. The average consumer will be able to buy homes at a low rate a while longer. Savings will lose it luster in an economy already not into doing it. The global impact is of great concern to everyone including Americans of course.